How to configure taxes in Uplisting

Configure your taxes through Uplisting for Upsell items

Overview

Some functionalities like the manual upsell items allow you to select a tax. When you select a tax, it will be added on top of the price of the item as long as it is exclusive. In case of Inclusive tax, it will not change the price of the item but will appear in the upsell charge price breakdown as a separate item calculated automatically.

How to Create a Tax

When you go to the Tax rates page, there’s a button “Add a new tax rate”. Clicking on it will expand a modal that allows you to configure a tax rate.

You can set up the VAT tax to be added and charged to guests here: https://app.uplisting.io/account/taxes

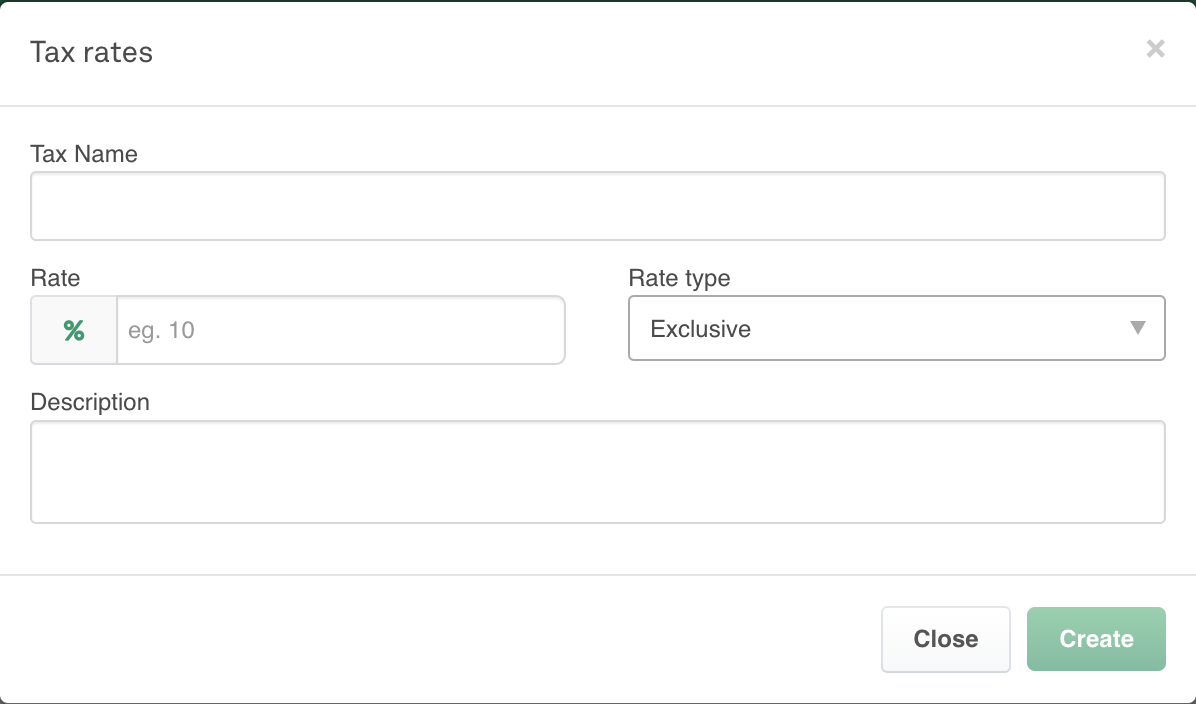

When you do so, you'll see this new screen pop up:

You'll need to enter the following properties:

- Tax name: The name of the tax; this is how it will appear in the drop-down for selecting a tax

- Rate: The percentage rate of the tax, i.e. VAT in the UK is at 20%

- Rate type: Taxes can be inclusive or exclusive.

- An inclusive tax rate type means that the tax will be part of the price set for the item. They will not modify the final price of the item.

- Example: You set an item cost of $10. The tax is 10%. The final item price is still $10, the tax will be $0.91, and item price excluding tax $9.09

- An Exclusive tax rate type means that the tax will not be included in the price set for the item. Therefore, Uplisting will add up to the item price, the amount of the tax.

- Example: You set an item cost of $10. The tax is 10%. The final item price is $11

- An inclusive tax rate type means that the tax will be part of the price set for the item. They will not modify the final price of the item.

- Description (optional): Open description explaining the tax rate.

Updated 4 months ago